Introduction

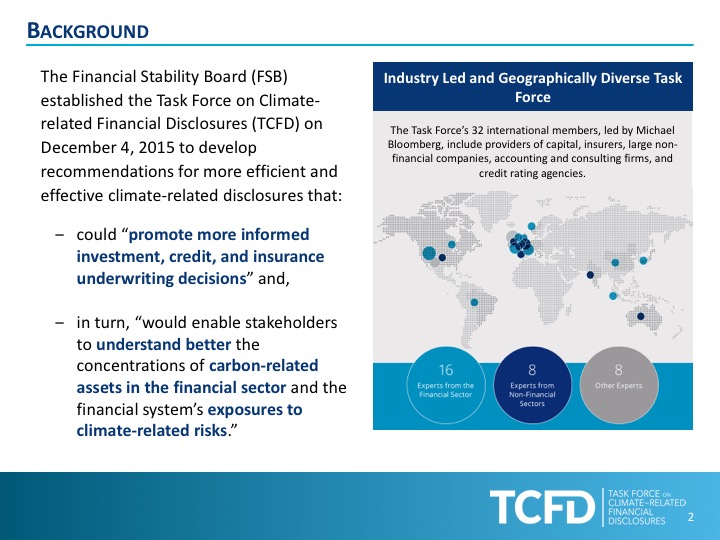

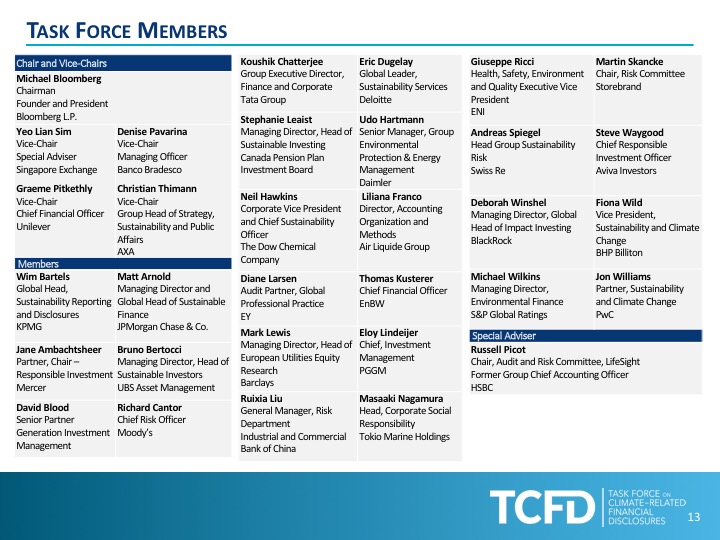

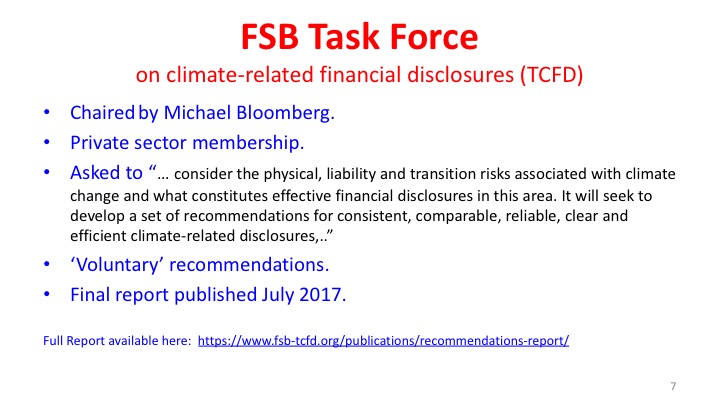

In 2016, the Financial Stability Board appointed Mr Michael Bloomberg to establish the Taskforce on Climate-related Financial Disclosures (Taskforce). Its primary role is to consider the climate change related risks to investments in the finance market.

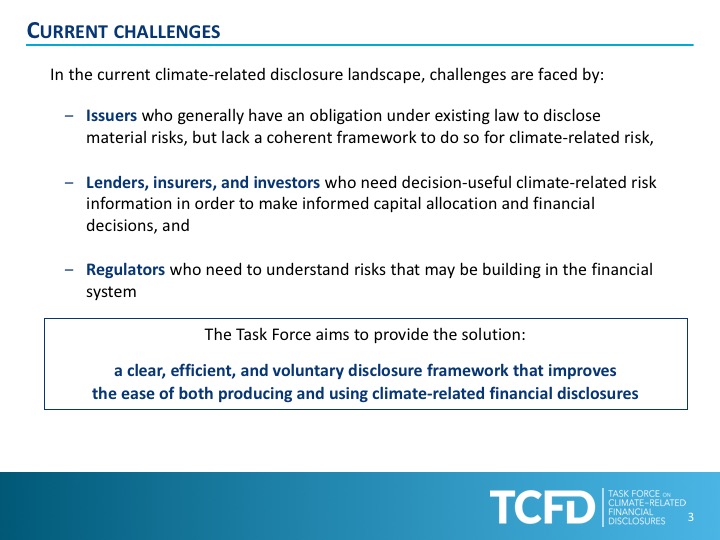

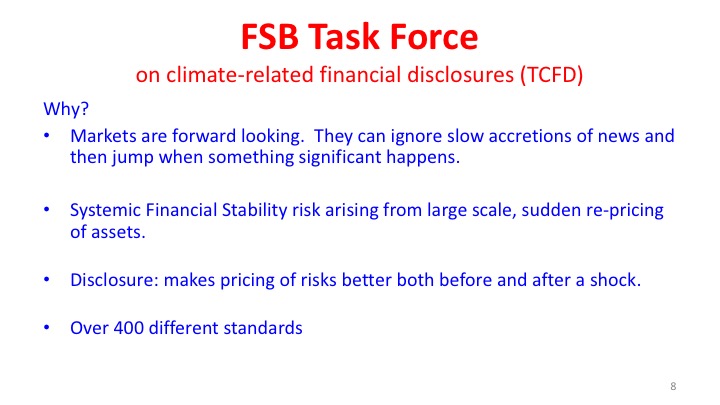

The Taskforce has published its recommendations and the market is now considering the new reporting requirements. They represent a substantial change in the way firms report risks. In Australia, the regulator that has oversight of the finance market has indicated it seriously considering these developments.

Adrian King, KPMG partner responsible for Sustainability Services was the MC and panel moderator.

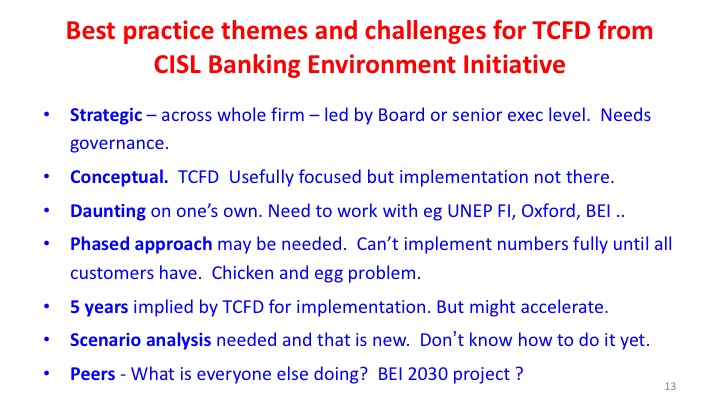

The strong messages from the conference were that:

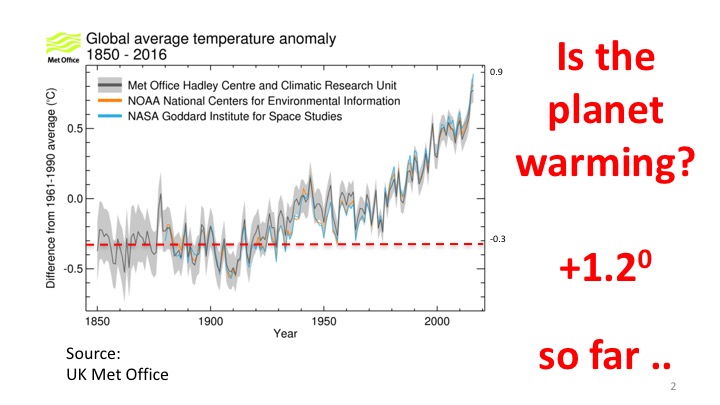

The risks presented by climate change should be treated in the same manner as any other business risk.

Risks are materialising today – consider the current uncertainty in the Australian electricity sector. This is a material risk that needs to be considered by board Risk Committees now.

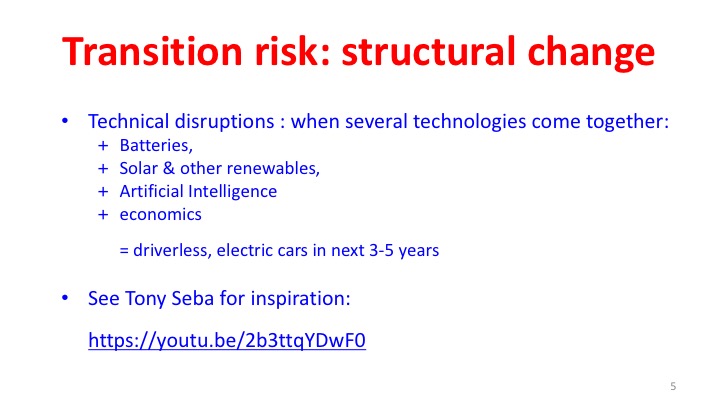

It is likely that the market will act independently of Governments. Firms will make decisions to manage their own risks or opportunities – even in the absence of strong policies.

Big data and publicly available information is enabling risk assessments of investments without the involvement of the stakeholders. In extreme cases, this could result in the investors suffering stranded assets.

Summaries from each of the speakers are available on this page. Click on the link below to go to your chosen speaker's summary.

Dr Fiona Wild

Fiona is VP Climate Change and Sustainability at BHP Billiton. She is accountable for all sustainability-related public policy issues. She leads the design and implementation of BHP Billiton’s climate change strategy, including activities in the areas of mitigation, adaptation, portfolio evaluation, stakeholder engagement and low emissions technology. Fiona is a member of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures, reporting to the G20.

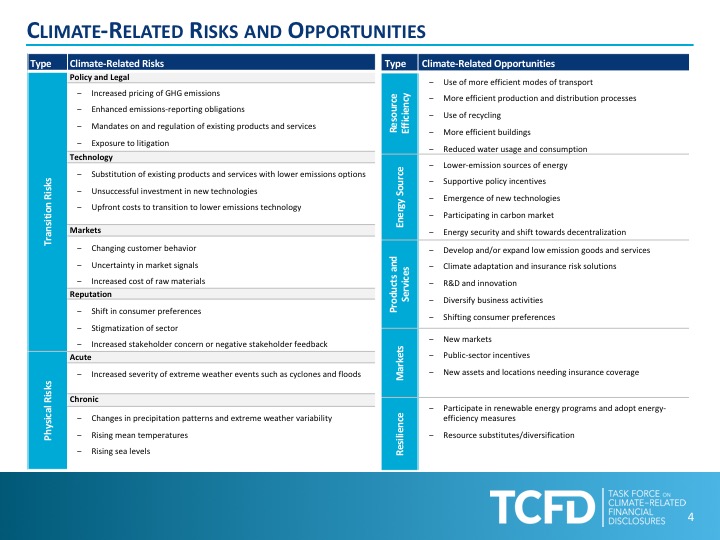

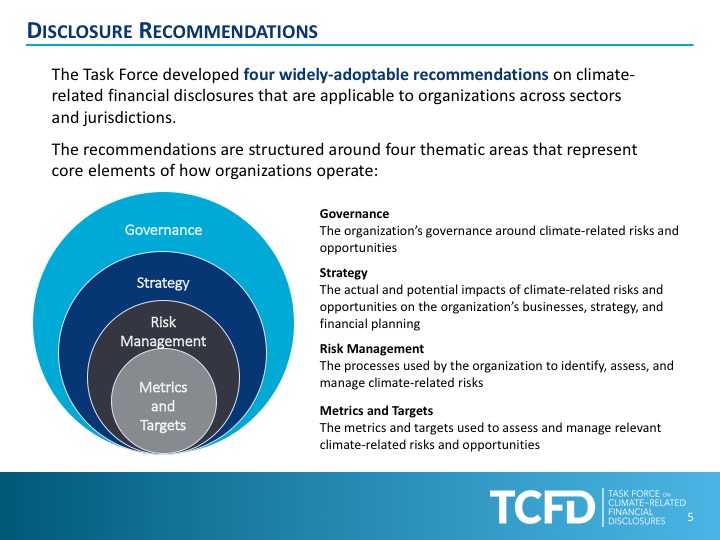

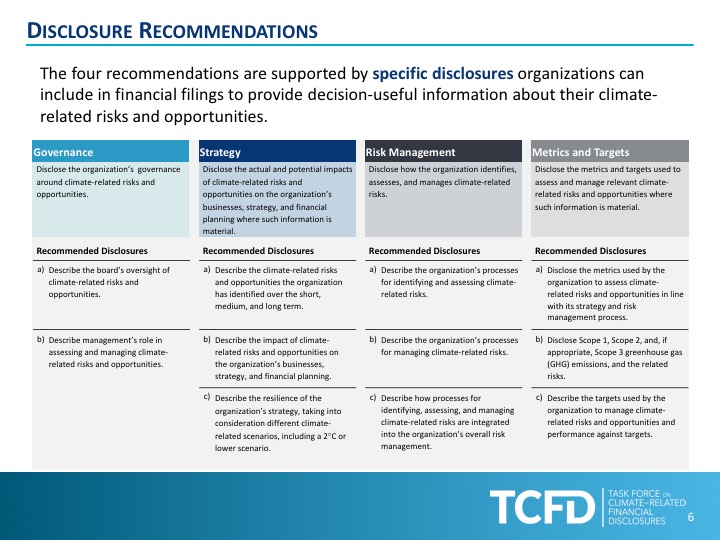

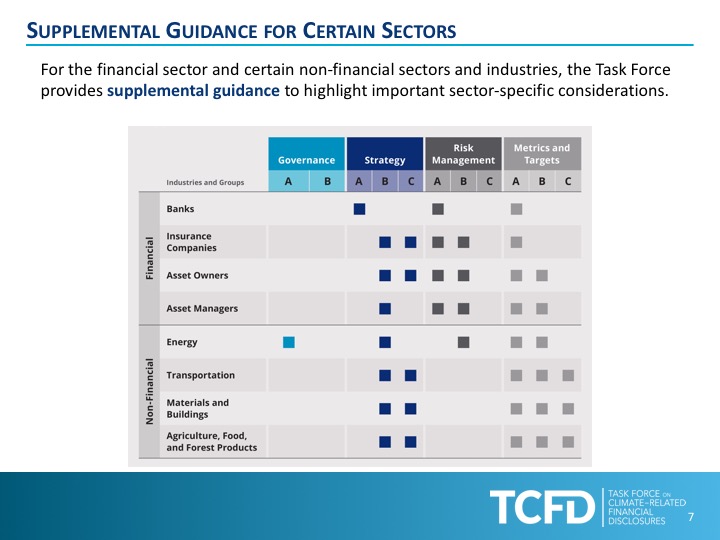

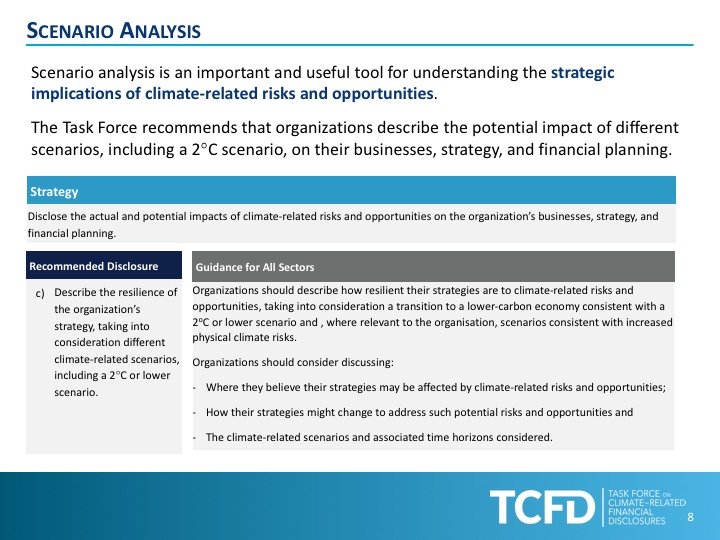

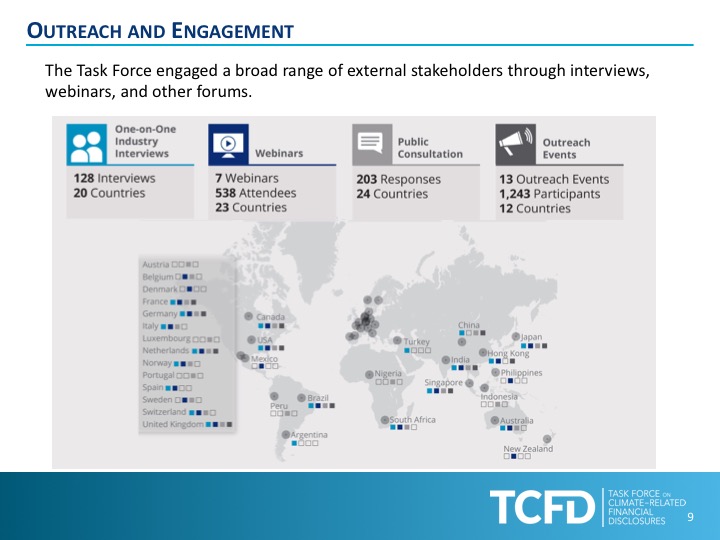

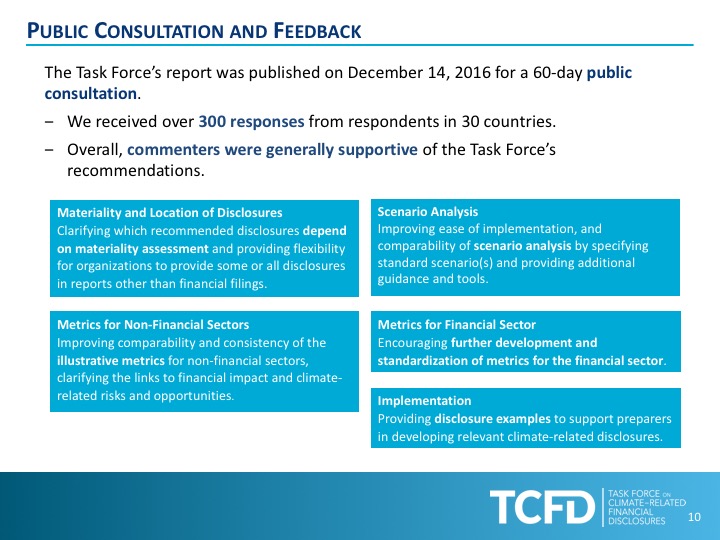

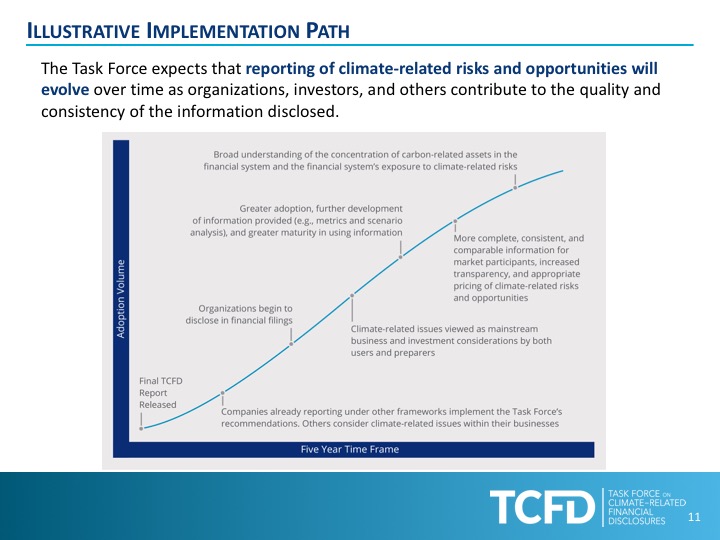

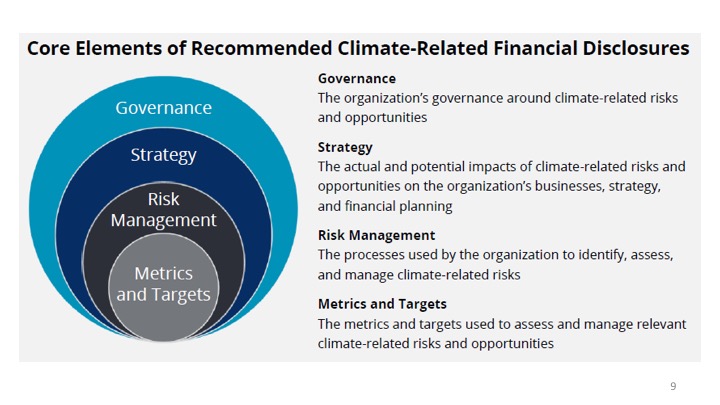

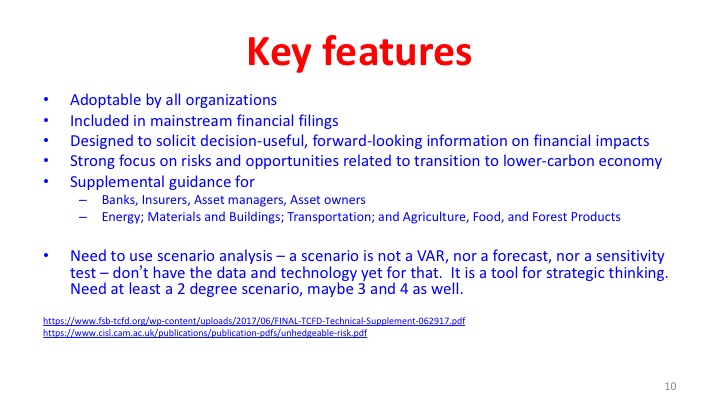

Fiona outlined the work the Taskforce has done to date, provided an overview of their recommendations and a snapshot of what is coming.

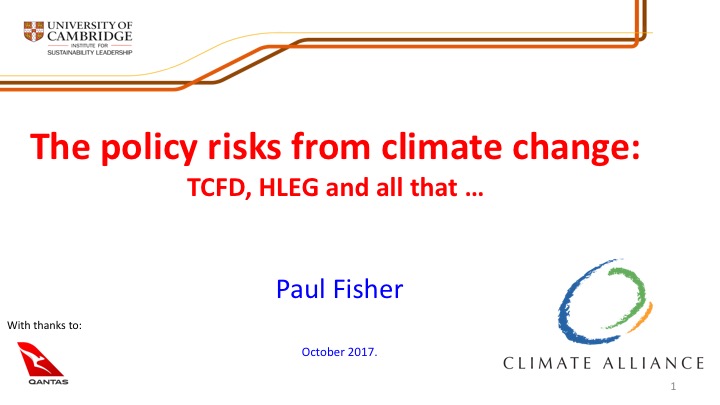

Dr Paul Fisher

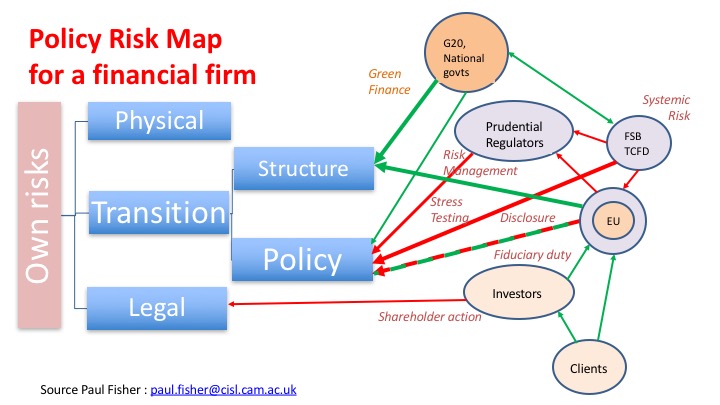

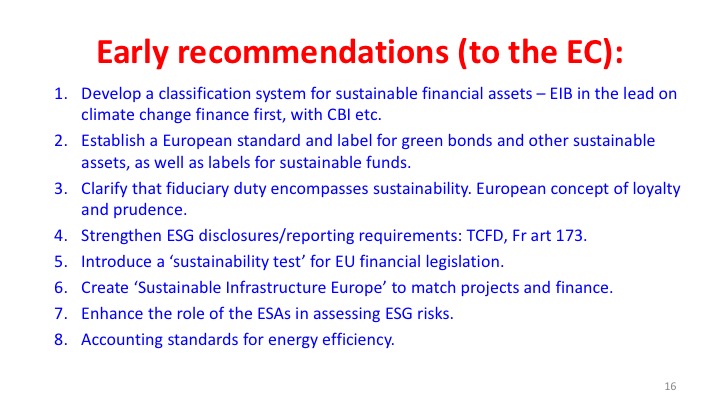

Until 2016, Paul was a senior executive at the Bank of England, where he was a member of the Monetary Policy Committee and Prudential Regulatory Authority Board. He is currently a member of the EU High-level Experts Group on Sustainable Finance and the UK Green Finance Task force.

Paul spoke about the wider policy risks from the transition, in particular how the EU is developing a comprehensive policy agenda on Sustainable Finance.

Chloe Munro

Chloe is a distinguished leader in the public and private sectors, with expertise in energy, infrastructure and natural resource markets. Chloe is the former Chair of the Clean Energy Regulator and, until recently, Chloe was a member of the Finkel Panel for the review of the national electricity market. She has since been engaged by the Australian Energy Market Operator to chair its Expert Panel assisting with the implementation of the Finkel Review recommendations.

Chloe spoke about how the Australian electricity market has tackled the transition a lower-carbon economy. Chloe's speech can be found here.

Dr Karl Mallon

Karl is a Director of Science and Systems at Climate Risk Pty Ltd and CEO of ClimateValuation. Karl has worked in climate change mitigation, policy and technical analysis since 1991. A major focus of Karl’s current work is the integration of hazard, engineering and financial data into high-speed cloud computing software to provide decision support systems.

Karl demonstrated some of the new disruptive technologies through the application of publicly available big data. These new applications are intended to provide a staged insight into property risk from extreme weather and climate change. They are starting off with coastal inundation risks, as this risk is not covered by insurance and people need to be especially careful before investing in property.

Over the coming months, ClimateValuation intends to add river flooding, bushfire, heat-waves and wind storms as the information becomes available. They have special offers on these products whilst they are in Beta (testing form) and if you do use one of these systems, they will let you know when new hazards are added so that you can re-test any properties you are following.

To better understand the capability of the application, look at some of the suburbs where there are more likely to be insurance increases and consequent valuation drops due to sea level rise. Firstly, visit the exposure maps at www.CoastalRisk.com.au

If you they have listed a property of interest to you, put the address in http://climatevaluation.com/home.html and run the numbers. Bear in mind they are looking at the end of the century where as we are analysing a 30-year mortgage. Remember that floor heights are an important factor on vulnerability - slab on ground at typically 10cm above ground, floating floors are about 40cm above ground level.